UAE Consumers Drive FMCG and Tech Spending Despite Slower Growth

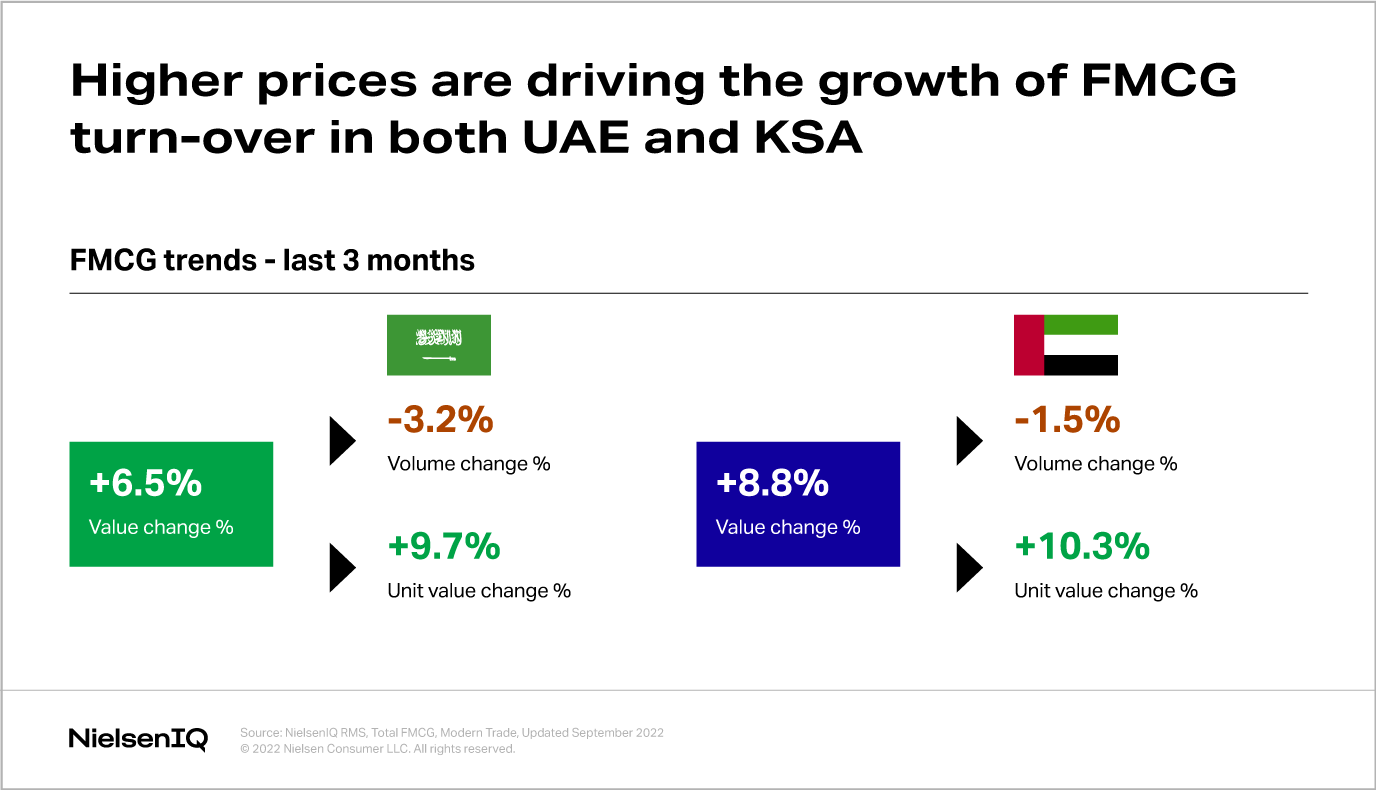

The NielsenIQ report highlights a noteworthy trend: consumers in the UAE are prioritizing spending on everyday necessities and technology, even as overall economic growth shows signs of deceleration. The FMCG sector saw a substantial uptick, with spending on food and beverages rising by 8% compared to the previous quarter. This increase is attributed to higher prices and a growing demand for premium products as consumers seek quality amidst inflationary pressures.

In the technology sector, expenditure on electronics, including smartphones, laptops, and home entertainment systems, surged by 12%. This growth is driven by ongoing digital transformation, with more consumers investing in tech to enhance their lifestyles and work-from-home setups. The robust demand for the latest gadgets reflects a broader trend of technological integration into daily life, which continues to gain momentum.

The uptick in spending comes despite a broader economic slowdown. The UAE’s economy has faced challenges such as fluctuating oil prices and global economic uncertainties, which have moderated growth expectations. However, consumer behavior in the FMCG and tech sectors indicates a divergence from these broader economic trends. Shoppers are adjusting their spending patterns, demonstrating a preference for products that offer immediate utility and long-term value.

The rise in FMCG spending is particularly notable in categories such as health and wellness products. With an increased focus on personal well-being, consumers are willing to allocate a larger portion of their budgets to healthier food options and supplements. This shift is evident in the growing market share of organic and fortified products, which have seen a significant rise in demand.

Similarly, technology spending has been bolstered by the release of new product lines and advancements in digital solutions. The UAE market has embraced innovations such as 5G-enabled devices and smart home technology, which have become integral to modern living. This investment in technology underscores a broader trend of digital adoption, with consumers increasingly integrating advanced gadgets into their everyday routines.

Retailers in the UAE are adapting to these shifts by enhancing their offerings and marketing strategies. Many are focusing on promoting high-demand products and leveraging digital channels to reach tech-savvy consumers. Additionally, there is a noticeable increase in promotional activities and discounts aimed at driving consumer engagement and encouraging higher spending.

The data from NielsenIQ also sheds light on the evolving consumer landscape in the UAE. There is a growing segment of affluent shoppers who are less sensitive to economic fluctuations and more inclined to spend on discretionary items. This demographic is influencing overall market trends, contributing to the increased focus on high-end FMCG and technology products.

In contrast, sectors not aligned with immediate consumer needs or technological advancements have seen slower growth. Categories such as luxury goods and non-essential services are experiencing subdued demand, reflecting a more cautious approach among consumers in less essential spending areas.

Join the conversation