Bitcoin Miners See Production Dip

Hut 8, a major North American Bitcoin mining company, witnessed a significant decline in Bitcoin production in April. The company produced 148 Bitcoin last month, reflecting a steep 36% drop compared to March. This news comes amidst a broader slowdown in Bitcoin mining across the industry, though the impact appears to be less severe for Hut 8's competitors.

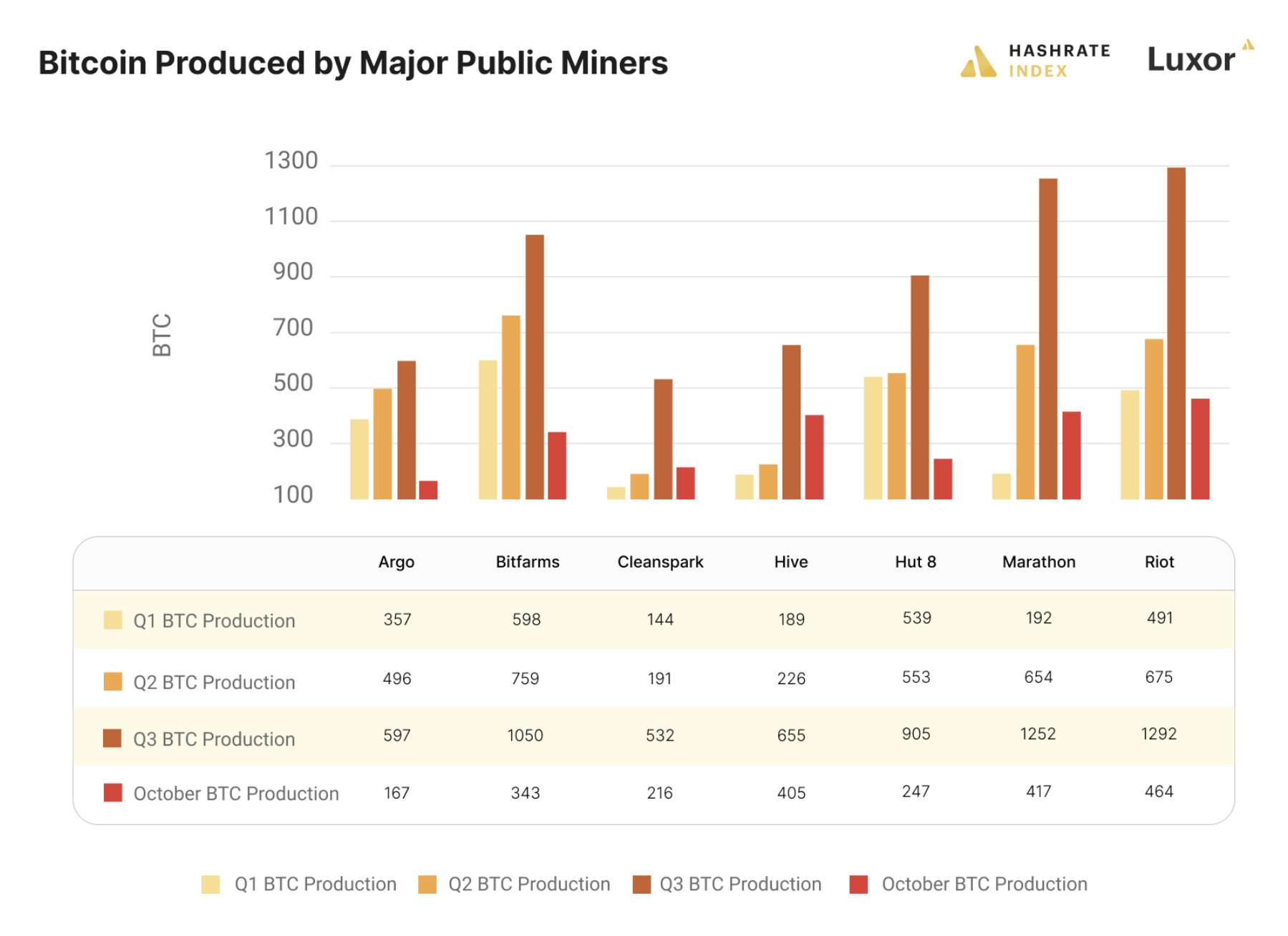

Several other publicly traded mining companies, including Bitfarms, Cipher, CleanSpark, Core Scientific, Riot, and Terawulf, reported a production decrease between 6% and 12% in April. This decline can be attributed, in part, to the recent Bitcoin halving event that effectively cut miners' rewards in half. However, the robust Bitcoin fee market seems to have offered some temporary relief, mitigating the full impact of the halving for these companies.

Hut 8's steeper production decline can likely be explained by an additional factor – the relocation of its mining rigs from two facilities in Kearney and Granbury. Marathon Digital, another major mining player, acquired these facilities in December and expedited the eviction of existing tenants, including Hut 8, in February. This disruption to Hut 8's operations significantly hampered its Bitcoin production in April.

The health of the Bitcoin mining industry depends heavily on the price of Bitcoin and the cost of electricity used for mining. While the Bitcoin halving has undeniably impacted profitability, the recent surge in Bitcoin fees has provided some cushion. Transaction fees on the Bitcoin network have risen due to increased network activity, offering miners an alternative source of income to partially offset the reduced block rewards.

Looking ahead, the future of Bitcoin mining profitability remains uncertain. The industry is likely to experience continued volatility as factors like Bitcoin price fluctuations, network difficulty adjustments, and operational costs play out. Hut 8's ability to navigate these challenges will depend on its success in securing new hosting facilities for its miners and its efforts to optimize its operations for efficiency. The performance of other mining companies will also hinge on their ability to adapt to the evolving market conditions.

Join the conversation