Inflation Shows Signs of Cooling in February Report

The Bureau of Labor Statistics released its latest Consumer Price Index (CPI) data today, indicating a slight moderation in inflation. Year-over-year inflation came in at 3.1%, down from 3.5% in January. This is also marginally better than the forecasted rate of 3.2%. The monthly increase in prices remained steady at 0.4%, meeting analysts' expectations.

The report offers some relief to the Federal Reserve as it navigates the complex task of managing inflation while fostering a robust economic recovery. While price hikes are still significant compared to pre-pandemic levels, the February data suggests a potential easing of inflationary pressures.

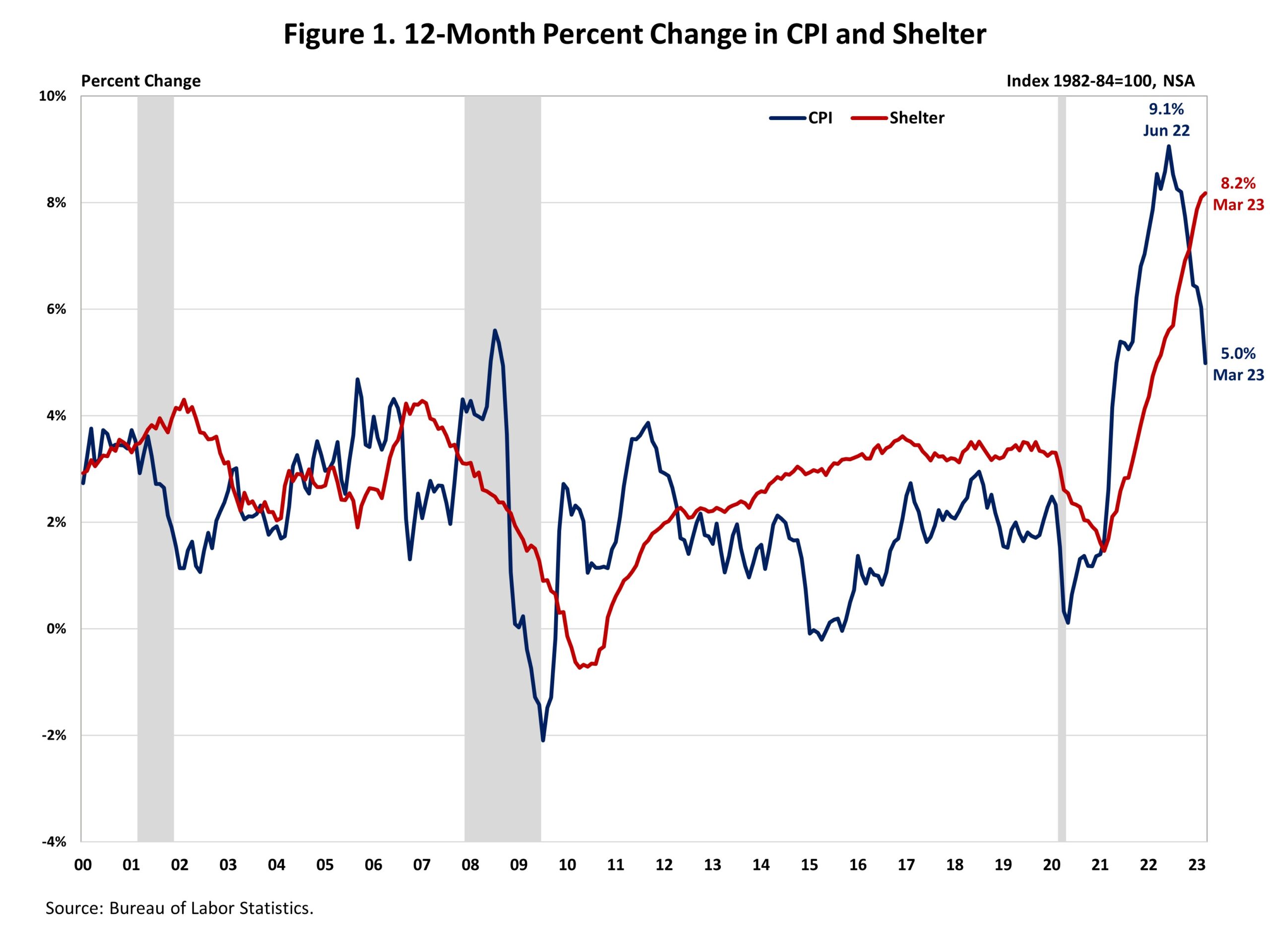

Breaking down the figures, the energy sector played a key role in the slowdown. The energy index dipped by 0.9% in February, largely due to a decline in gasoline prices. This helped offset rising costs in other areas, such as shelter, which continues to be a major contributor to inflation. The index for shelter rose 0.6% in January, accounting for over two-thirds of the overall monthly increase in CPI.

The food index also crept up slightly, rising 0.4% in January. This increase was spread across both food at home and food away from home categories. Excluding food and energy, the core CPI index rose 0.4%, indicating underlying inflationary trends may be moderating as well. This core inflation rate is currently at 3.9%, down from a peak of 4.3% in September 2023.

The Federal Reserve will be closely monitoring the inflation data in the coming months to determine the appropriate course of action for interest rates. While today's report offers some encouragement, the Fed is likely to remain cautious until it is confident that inflation is on a sustained downward trajectory.

The slowdown in inflation is a welcome development for American consumers who have been grappling with rising prices for essential goods and services. However, it is important to remember that inflation remains well above the Fed's target of 2%. The central bank will need to see continued progress on inflation before it can significantly alter its monetary policy stance.

Join the conversation