Finance Giants Propel UAE Real Estate with Cross-Border Payment Options

UAE's real estate sector is experiencing a significant upswing, fueled by leading financial institutions facilitating cross-border payments for global property investors. This development emerges as a pivotal force, reshaping investment dynamics and expanding opportunities within the country's real estate landscape.

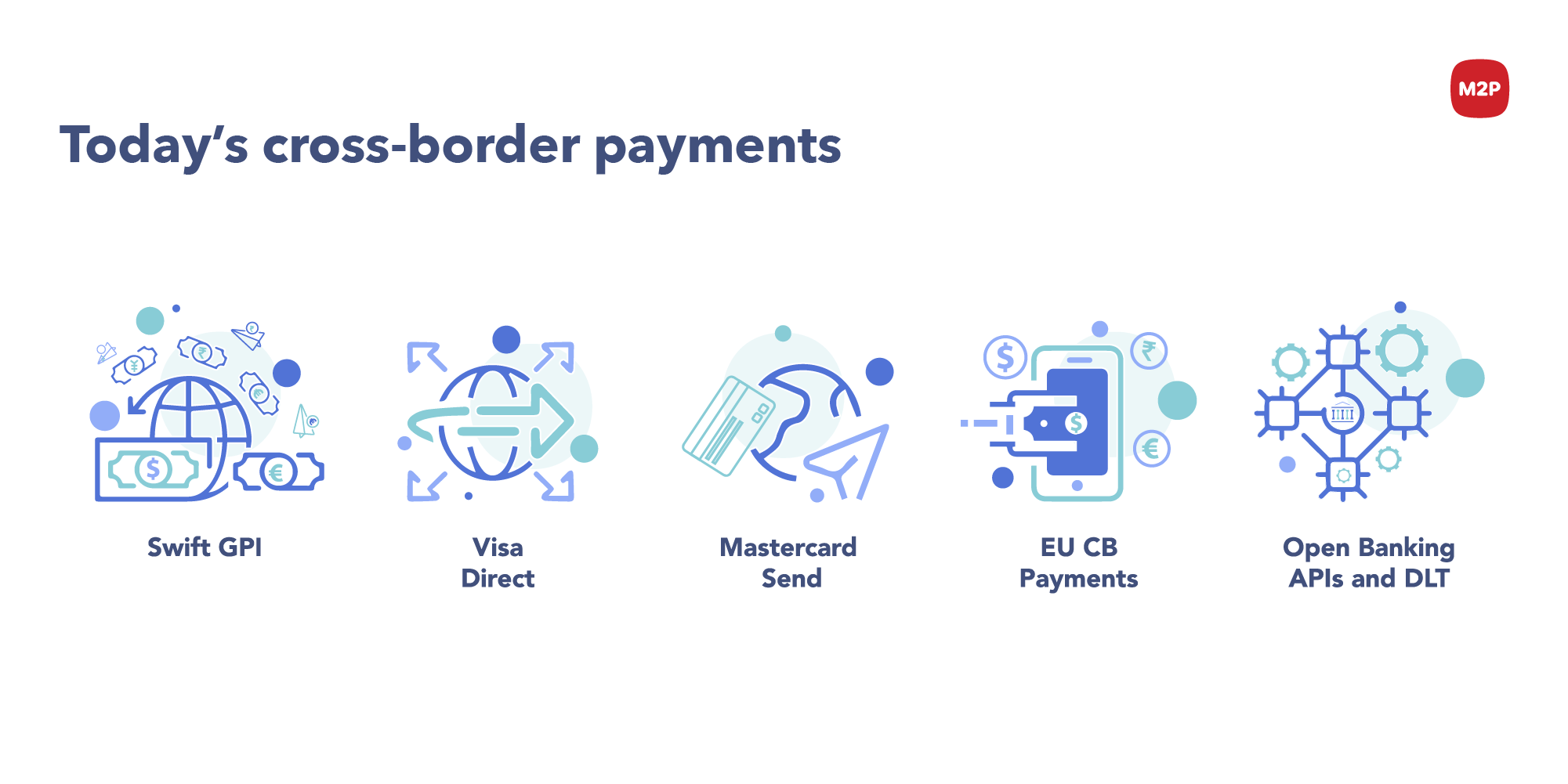

The infusion of cross-border payment solutions by major finance giants is set to streamline transactions for international investors eyeing properties in the UAE. This strategic move aligns with the nation's vision to foster a more investor-friendly environment, attracting a diverse range of global players seeking lucrative opportunities in the flourishing real estate market.

With this financial initiative, the process of acquiring real estate in the UAE becomes more accessible and efficient for international investors. The elimination of cumbersome payment barriers is poised to catalyze a surge in foreign investments, injecting vitality into the real estate market and contributing to the overall economic growth of the nation.

Prominent financial institutions leading this transformative change emphasize the seamless nature of the cross-border payment platform. Investors can now navigate transactions with greater ease, mitigating challenges associated with traditional payment processes. The implementation of these solutions not only enhances the investor experience but also bolsters the UAE's reputation as a progressive and attractive destination for global investments.

In response to market demands, these finance giants have fine-tuned their services to meet the specific needs of the real estate sector. Customized solutions cater to the nuances of property transactions, ensuring a secure and swift process. The incorporation of cutting-edge financial technology underscores the commitment of these institutions to provide innovative solutions that align with the evolving landscape of international real estate investments.

Industry experts foresee a substantial increase in foreign investors entering the UAE real estate market, drawn by the newfound convenience and efficiency in cross-border transactions. The ripple effect of this surge is anticipated to stimulate economic sectors associated with real estate, amplifying job creation and fostering a more robust business ecosystem.

Local real estate developers and stakeholders welcome this financial evolution, recognizing its potential to elevate the market to unprecedented heights. The collaboration between finance giants and the real estate sector signifies a symbiotic relationship, where both parties stand to benefit from the ensuing economic vibrancy.

As the UAE continues to position itself as a global hub for investment, these strategic financial initiatives contribute to the nation's economic diversification goals. The real estate market, in particular, emerges as a focal point for international investors seeking stability, growth, and a strategic entry point into the Middle East market.

Join the conversation